If you're not sure whether growth stocks or value stocks are the way to go for 2021, I've got an answer for you. Don't accept an either-or choice. You can find growth stocks that already have value.

You can do well by going against the conventional wisdom when considering these companies: Quidel (NASDAQ:QDEL) is not just a COVID stock; Abbott Laboratories (NYSE:ABT) is not just a solid pharmaceutical company with a nice dividend; and CVS Health (NYSE:CVS) is diversified enough to thrive even amid rising competition from e-pharmacies.

IMAGE SOURCE: GETTY IMAGES

1. Quidel was overpriced, but it's not anymore

Quidel's shares are up more than 33% over the past 12 months, but down more than 30% so far in 2021. The widely held view among investors is that the medical diagnostic solutions company benefitted greatly from the need for COVID-19 testing, but will lose that tailwind if the pandemic subsides as expected in the coming months.

But there are a few reasons why investors should remain excited about this company. While 2020 was a tremendous year for it thanks to sales of its COVID-19 diagnostic products, Quidel had five consecutive years of revenue growth prior to that. It's unlikely that 2021's revenue growth will be as steep as it was in 2020 (when it more than tripled), but this is a very profitable company with a 6.6 price-to-earnings (P/E) ratio and a gross margin of more than 87%. In a January presentation to investors, Quidel said it expects to double its 2020 revenue this year.

The company's revenues in 2020 were $1.66 billion -- up 211% over the prior year -- and earnings per diluted share were $18.60, compared to $1.73 per share in 2019.

On Friday, March 26, the stock closed at $126.30 per share. That's a long way down from the $306 it touched on Aug. 6. This presents a great opportunity. The need for COVID-19 testing may wane, but it won't disappear for some time, particularly as more workplaces begin to reopen.

The great thing about the company's 2020 performance is that it was able to expand its customer base, and those same customers may buy its other immunoassays for the flu, strep A, and respiratory syncytial virus. On top of that, Quidel's cardiometabolic disease immunoassay revenue in Q4 was $70 million, up 8% sequentially and 6% year over year. Looking past the pandemic, the company said it expects its revenues from other testing products, like the cardiometabolic disease immunoassay, to have a compound annual growth rate (CAGR) of 18% through 2024.

2. Abbott Labs offers growth, plus a dependable dividend

When investors think about Abbott Labs, they often focus on the fact that it's a Dividend Aristocrat -- and its 49-year streak of raising its payouts is certainly a plus. The company last boosted the quarterly dividend in December, to $0.45 a share, a 25% increase. At Friday's closing price of $122.07, that gives it a yield of 1.47%. Its shares are up more than 63% over the past 12 months and up more than 11% thus far in 2021.

Abbott's full-year revenue in 2020 grew 9.8% to $34.6 billion, and management is forecasting 35% revenue growth in 2021. Part of that success story is COVID-19 related: Revenue from its diagnostic testing segment gained 40.1% year over year. However, Abbott is a diversified business, and when the pandemic is over, sales in its other segments should pick up. Revenues from its nutrition unit rose by 3.2% last year anyway, with products such as Ensure, a meal replacement shake, Glucerna, a nutrition shake for diabetics, and infant formula Similac doing well. But its pharmaceutical revenue was down by 4.1% and medical devices revenue fell by 3.7%.

The company expects both of those lagging segments to bounce back once more people start feeling comfortable about visiting doctors' offices for routine care. The company launched medical devices last year that should help grow revenue: the FreeStyle Libre 2 system for diabetes in the U.S. and the FreeStyle Libre 3 system in Europe, as well as the MitraClip G4 heart valve device.

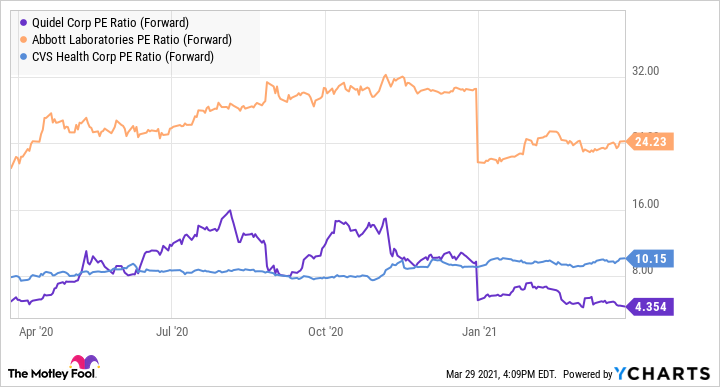

QDEL PE Ratio (Forward) data by YCharts

3. CVS Health is poised for a big jump

Investors may not find CVS Health to be that exciting, but they should. Though the company's shares are up by more than 30% over the past 12 months and more than 11% in 2021, at a P/E ratio of 13.9, they're still underpriced compared to other healthcare companies.

COVID-19 had a big impact on the company's pharmaceutical and retail sales in 2020, yet CVS came through the year with revenue growth of 4.6% to $268.7 billion, and net income of $7.2 billion compared to $6.6 billion in 2019. Since its purchase of Aetna in 2018, the company has been steadily paying down its debt, including $12.2 billion in 2020. CVS also has a solid quarterly dividend of $0.50 a share, which offers a yield, based on Friday's closing price, of 2.63% and a very sustainable payout ratio of 26.61%.

Here are a few reasons why I see big things ahead for CVS in 2021. Growth in the company's top-performing segment, health care benefits, seems to be accelerating: Last year, its revenue rose 8.4% to $75.4 billion, and fourth-quarter revenue of $19.1 billion was up 11.4% year over year. The company's pharmacy services segment lagged a bit last year, with revenue gains of 0.3% compared to 2019. While the revenues from the company's retail segment were up 5.3%, they would have been up by even more if it weren't for the slowdown in front-of-store sales, which fell 1.1% for the year. Sales in both of those segments will grow as the pandemic ebbs. In addition, CVS is one of the primary locations people are going to for their COVID-19 shots, which will increase foot traffic to its stores.

Solid choices all around

The uneven first few months of 2021 have left a lot of investors looking for stability. These stocks can provide some. All three companies are profitable and grew revenue last year, and all will likely do so again this year, making them easy choices to add to one's portfolio.

If I had to choose just one of them, I'd go with CVS. It seems to have a good opportunity for growth in 2021, and with its current forward P/E of 10.1, there's plenty of upside. Quidel poses a bit more risk, but the broad plan to get more people back into their workplaces this year will demand continued COVID-19 testing. In terms of valuations, Abbott is a bit pricier than the other two, but it also stands to blossom this year once its medical devices segment shifts back into gear.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

"make" - Google News

March 30, 2021 at 05:40PM

https://ift.tt/3w9QVJl

These 3 Stocks Will Make You Rethink Your Portfolio - Motley Fool

"make" - Google News

https://ift.tt/2WG7dIG

https://ift.tt/2z10xgv

Bagikan Berita Ini

0 Response to "These 3 Stocks Will Make You Rethink Your Portfolio - Motley Fool"

Post a Comment