As Congress debates what to include in the next coronavirus stimulus bill, around 30 million Americans will officially fall off an "income cliff:" Starting Aug. 1, their weekly unemployment insurance payments will drop by $600 as the federal enhanced benefit put in place under the CARES Act expires.

That could mean a two-thirds decrease in income for some, according to an analysis by the House Ways and Means Committee. And because Congress did not pass another bill this month, benefits will lapse for at least a few weeks.

"This represents a major drop in living standards for millions of Americans, forcing people to survive on far less than they had been earning prior to the pandemic and cut spending on necessities — with negative ripple effects throughout the economy," writes Thea M. Lee, president of the Economic Policy Institute, a left-leaning policy think tank.

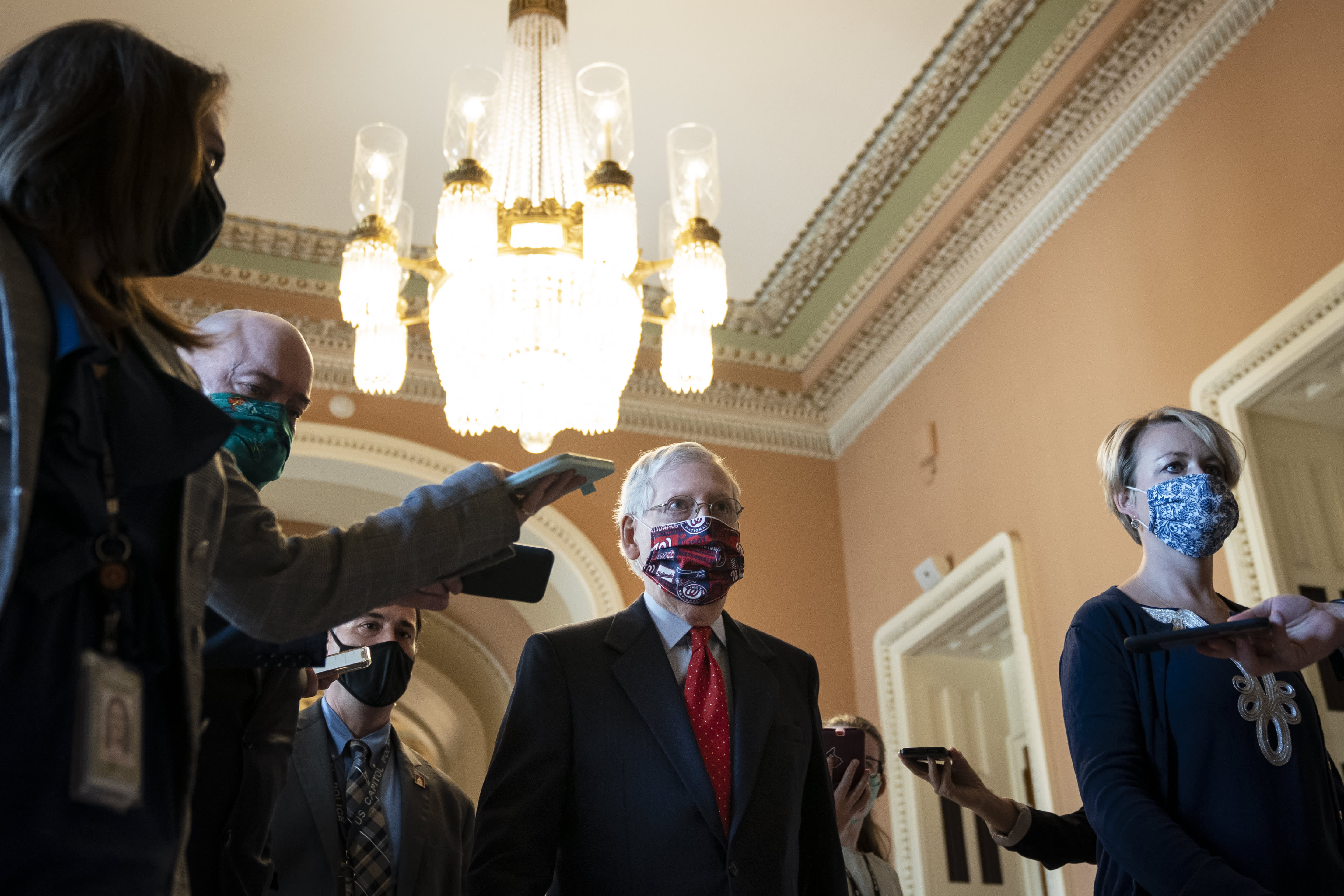

Congressional Republicans are on board with including another one-time stimulus check in the next bill (though the exact amount of the payment is still being debated). It's what to do about unemployment insurance that is one of the sticking points in negotiations, according to reports.

Many Congressional Democrats want to keep the weekly stipend at $600. Meanwhile, Senate Republicans have proposed cutting enhanced UI to $200 per week through September, then implementing a 70% replacement wage.

UI expansion boosts consumer spending

The GOP argues that keeping UI benefits at $600 will discourage people from returning to work. However, study after study has found this not to be true, especially when there are currently four people unemployed for every one available job, according to the U.S. Department of Labor.

But a one-time check won't make up for the missing weekly benefit payments: Nearly 50% of recipients spent the first stimulus check within the first week of receiving it, according to a survey from Stash, a financial technology company. And the Congressional Budget Office is projecting that the unemployment rate will still be above 10% in the first quarter of 2021, highlighting the need for ongoing aid.

Enhanced unemployment insurance has kept consumer spending flowing as the U.S. economy tries to recover from the past few months of coronavirus-induced free fall, according to an analysis from the JP Morgan Chase Institute — especially for those who lost their jobs and need money the most. The report found that $440 of the extra $600 is spent within the first week of receiving it.

"This is spending that is helping unemployed survive the pandemic, and these [money] then flow to businesses and help the overall economy," Joe Vavra, an economist at the University of Chicago Booth School of Business and one of the authors of the report, tweeted. He estimates that cutting the benefit would mean a decrease in consumer spending of $13 billion per week.

"UI expansion is really boosting spending, so be wary of cutting it too fast," Vavra tweeted.

Spending on enhanced Supplemental Nutrition Assistance Program, or SNAP, benefits, and the increased unemployment assistance are the two factors that will provide the most meaningful boost to the U.S. economy over the next year, according to Moody's Analytics chief economist Mark Zandi and Harvard economics professor Raj Chetty.

"make" - Google News

August 01, 2020 at 02:55AM

https://ift.tt/3159D6a

Another $1,200 stimulus check won't make up for loss of the $600 enhanced unemployment insurance - CNBC

"make" - Google News

https://ift.tt/2WG7dIG

https://ift.tt/2z10xgv

Bagikan Berita Ini

0 Response to "Another $1,200 stimulus check won't make up for loss of the $600 enhanced unemployment insurance - CNBC"

Post a Comment