makaanlontong.blogspot.com

Adblock test (Why?)

"Love" - Google News

October 20, 2023 at 11:42PM

https://ift.tt/nGvsMDb

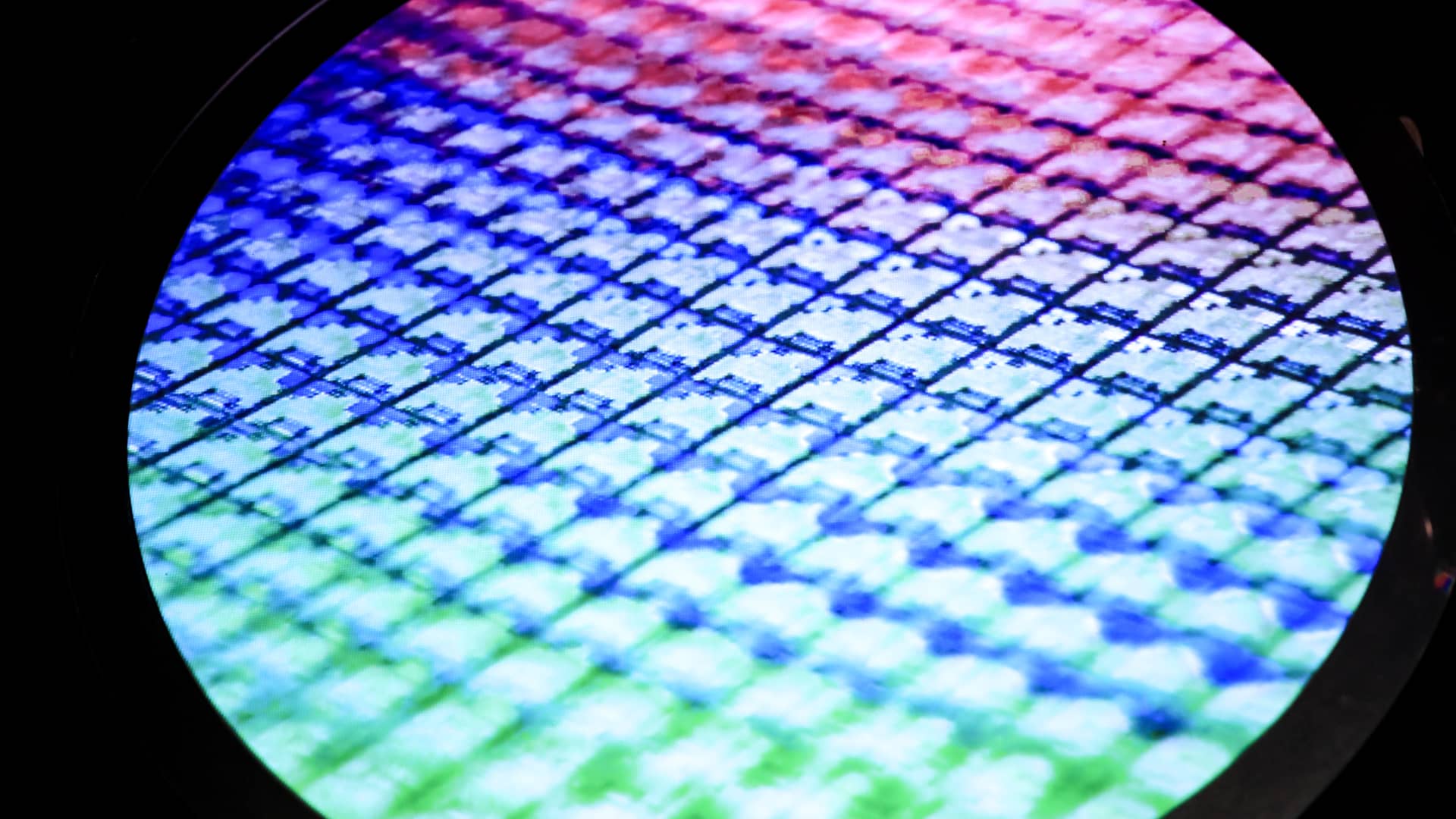

The chip stock is getting a ton of love from Wall Street, and it's not Nvidia - CNBC

"Love" - Google News

https://ift.tt/oKHf3gt

https://ift.tt/8aDrAU1

Bagikan Berita Ini

0 Response to "The chip stock is getting a ton of love from Wall Street, and it's not Nvidia - CNBC"

Post a Comment