New Jersey Governor Phil Murphy (D) and lawmakers have agreed on a plan to make the largest public pension contribution in the state’s history, moving to ensure the solvency of a chronically underfunded system at a time of great economic uncertainty.

Under the plan, the state will make a $4.7 billion payment before the next budget year ends June 30, 2021. Policymakers approved the pension contribution as part of the fiscal year 2021 budget adopted Sept. 24. Murphy signed the measure Sept. 29, just before the Oct. 1 start of the new fiscal year. New Jersey pushed out the end of fiscal 2020 from June 30 to Sept. 30 as it navigated the impact of revenue fluctuations caused by the COVID-19 pandemic.

New Jersey’s commitment to its worker retirement fund is unusual in a year in which the rapid spread of the novel coronavirus triggered a recession that has sharply reduced government revenues nationwide. In response, some states have delayed or reduced pension system contributions to help plug budget gaps.

Murphy said he will rely on a combination of spending cuts, tax increases, and borrowing to cover a $6 billion state budget shortfall—and will keep his pledge to boost pension payments.

Research by The Pew Charitable Trusts shows that New Jersey’s defined benefit pension system for government workers has long been among the worst funded in the country. Pew has also advocated for pension stress tests, which New Jersey has used in recent years to help assess how the system would perform under different economic scenarios.

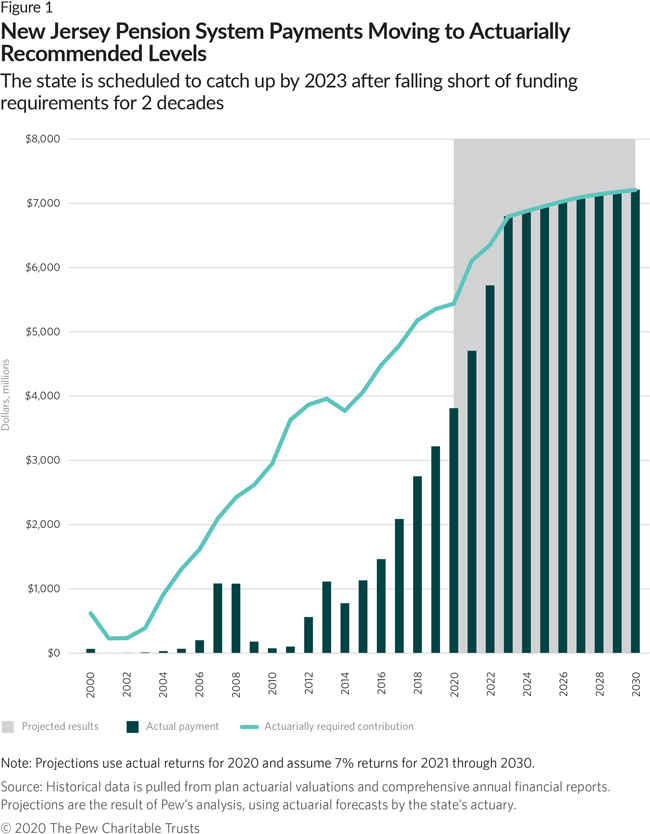

The system’s underfunding issues had been building for years. Between 2000 and 2017 the state made less than 25% of its annual required contributions, falling short of system needs by over $30 billion over that time. To address the underfunding, lawmakers first enacted substantial reforms in 2011 and, after some setbacks, recommitted to working toward making the full actuarially recommended contribution starting in 2017. The 2021 planned payment represents the fifth consecutive increase since 2017 and is a significant jump from the $3.9 billion contributed in fiscal 2020.

Twenty years ago, New Jersey’s pension plans were more than 100% funded, and leaders decided to increase worker pension benefits while reducing state contributions. In 2005, New Jersey made only 5% of its required contribution, but the system was still close to 80% funded. By 2015, the funded ratio—the value of plan assets in proportion to pension liabilities—had fallen to 47%. The available assets would cover just eight years of benefits. As of 2018, New Jersey ranked last among states with only 38% of assets on hand to pay for promised benefits.

This year, revenue declines related to the pandemic created new spending pressures that made a big increase in pension contributions—as a share of a $40 billion state budget—especially challenging. But the governor and legislative leaders found the stress test data convincing and agreed to increase contributions despite a recession.

Stress testing uses a rigorous simulation technique that provides the comprehensive data and analysis needed to make such difficult decisions. This approach can help policymakers prepare for the effects of adverse conditions on pension balance sheets and government budgets. The findings also can be used to evaluate reform proposals and provide early warnings if more actions are needed.

New Jersey enacted its stress testing requirement in 2018 and is now one of 12 states with such a law. Policymakers in Trenton have worked to obtain the needed financial data to ensure they are better funding their plans. Although the state has lagged others in managing its pension system, it was among the first to adopt stress testing.

Pew published a stress test of 10 state pension systems, including New Jersey’s, in 2018. The analysis found that an economic crisis could deplete plan assets unless policymakers rigidly adhered to their updated funding policies. The testing showed that New Jersey was at a greater risk of insolvency than any other state and that hitting that point could increase costs by more than $4 billion annually.

This year, the state actuary produced timely projections that assessed the impact of COVID-19 on pension plan balance sheets. In addition, Pew provided an independent stress test analysis to Senate President Stephen Sweeney (D) and then to state policymakers. The results of that analysis, which included a new framework to account for the economic impact of the pandemic on state finances and pension investments, indicated the $4.7 billion payment was only slightly over the minimum contribution required to protect against fiscal distress. The full payment illustrates New Jersey’s fiscal discipline as well as leaders’ commitment to pensioners and stabilizing the state pension systems.

The stress test results had been clear. Despite the fiscal challenges, New Jersey could not postpone or reduce pension contributions without risking collapse of the retirement system. For other states facing unprecedented budget challenges in the year ahead, New Jersey’s approach demonstrates how policymakers can commit to maintaining fiscal discipline and rely on nonpartisan, data-driven analysis to point the way.

David Draine is a senior officer, Corryn Hall is an officer, and Emma Wei is a senior associate with Pew’s public sector retirement systems project.

"make" - Google News

October 02, 2020 at 03:15AM

https://ift.tt/2Sjki9u

New Jersey to Make Largest Pension Contribution in State History - The Pew Charitable Trusts

"make" - Google News

https://ift.tt/2WG7dIG

https://ift.tt/2z10xgv

Bagikan Berita Ini

0 Response to "New Jersey to Make Largest Pension Contribution in State History - The Pew Charitable Trusts"

Post a Comment